EPF Self Contribution is an EPF scheme where registered EPF members may make additional contributions to their EPF savings with any amount and at any time. Employees State Insurance Act 1948 Extends to Whole INDIA Whole India 2 Name of Scheme Employees Provident Fund Scheme.

Chemical Composition Poscoaapc

Basis EPF ESI 1 Acts Applicable The Employees Provident Funds And Miscellaneous Provident Act 1952.

. However as per the Union Budget 2019 announcements 60 of the accumulated corpus withdrawn at the time of retirement would enjoy tax exemption from the Fiscal Year 2020-21. If you are interested to know the calculation of the EPF contribution formula you have came to the right place. EPF Contribution Third Schedule.

The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme. In case of non-restricted contribution PF will be on actual contribution ie 12 of 15500 1860 which is the Employee contribution. 833 of employer contribution.

At First people from all the States in India except Jammu and Kashmir can apply under the provision of the EPF scheme. For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and. A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act.

College 2019-2024 The Commissioners. Generally it 367 of employer contribution towards PF when the basic wage of an employee is greater than 15000 then it will automatically calculate the PF contribution of employer. EPS contribution will be a maximum of 1250.

Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. The EPF interest rate is reviewed every year by the EPFO Central Board of Trustees after consultation with the Ministry of Finance.

Given below is the table for the calculation of the amount in case of premature closure of the account. Together the 27 Members of the College are the Commissions political leadership during a 5-year term. The Commission is composed of the College of Commissioners from 27 EU countries.

The contribution rates stated in this table are not applicable to new employees who are 57 years old and above who have no prior contribution. Atal Pension Yojana Calculation. EPF EPS Difference Remitted.

This includes salaried employees self-employed freelance worker and anyone who wish to better prepare for their retirement. Table below gives the rates of contribution of EPF EPS EDLI Admin charges in India. Therefore the NPS becomes a reliable saving option like PPF and EPF.

Examples of Allowable Deduction are. EPF helps in tax saving by keeping EPF contribution tax-deductible with respect to section 80C of the Income tax act1956. Sir EDLIS Administrative charges waived from.

SIP EIS Table. The review of the EPF interest rate for a financial year is set at the end of that financial year most probably in February but may go up to April or May. Monthly EPF contribution brought down to 20 for May June and July 2020 will now go back to its erstwhile figure of 24 starting August 1 2020.

Jadual PCB 2020 PCB Table 2018. Secondly EPF account registration has compulsory for salaried employees with an income of fewer than 15000 Rs per month. The European Commissions political leadership.

The EPF interest rate for FY2020-21 was 850 unchanged from FY2019-20. Since 2020 the default. January 2 2019 at 343 pm.

EPF Contributions To Be Deducted at 24 from August 1 2020. You can close the account by withdrawing the entire contribution made towards the account along with the interest that has been generated. EPF contributions tax relief up to RM4000 this is already taken into consideration by the salary calculator Life insurance premiums and takaful relief up to RM3000.

In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. However companies with less than 20 employees can join this scheme as well on the basis of Voluntary. Subscribers enjoying the co-contribution cannot be members of any statutory social security scheme and should not be paying income tax meaning their income should be below the income tax threshold.

Answer 1 of 4. Employees State Insurance Corporation. Establishment of the Board.

Employer contribution will be split as. They are assigned responsibility for specific policy areas by the President. EPF withdrawals at maturity or beyond 5 years attract zero tax in case if premature withdrawal is not done which helps in o.

Latest news related EPF withdrawal. Please bear in mind that the contribution amount should be calculated based on the contribution rate as stated in the Second Schedule of the Employment Insurance System Act 2017 instead of using the exact percentage calculation. 12 of employee contribution.

An additional 50000 may be deducted per annum under Section 80CCD 1B. The contribution split equally at the rate of 10 between the employer and. 3 Organisation Employees Provident Fund Organization EPFO.

Benefits of EPF Scheme. The Government will participate in this co-contribution for five years ie from Financial Year 2015-16 to 2019-20. Employer contribution will be split as.

PART II THE BOARD AND THE INVESTMENT PANEL. Both the rates of contribution are based on the total. Any extra contribution will go into EPF.

Pin By Chin Eu On Epf Kwap Ltat Lth Pnb Ptptn Investing Periodic Table Estimate

How To Calculate Pf Contribution And Challan Youtube

Public Provident Fund What Rs 1 5 Lakh A Year May Give You In 15 20 25 Years The Financial Express

Epf Contribution Table For Age Above 60 2019 Madalynngwf

Download Kwsp Deduction Table 2020 Background Kwspblogs

Eis Perkeso Eis Contribution Table Eis Table 2021

St Partners Plt Chartered Accountants Malaysia Monthly Contribution Rate Third Schedule The Latest Contribution Rate For Employees And Employers Effective April 2020 Salary Wage Can Be Referred In The Third Schedule

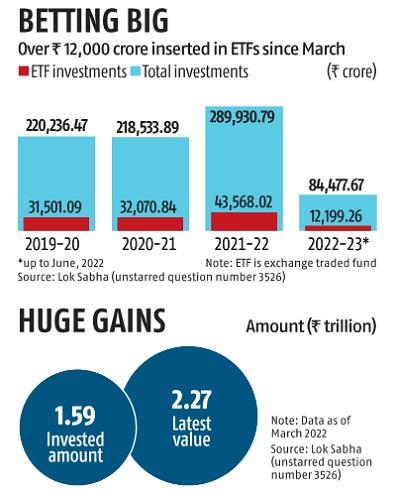

Epfo Made Over Rs 67 000 Crore From Exchange Traded Funds Shows Data Business Standard News

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Lost Your Job Or Planning To Quit Here S How You Can Benefit From Your Epf

Epf Contribution Table For Age Above 60 2019 Madalynngwf

Top 5 Best Tax Saving Elss Mutual Funds 2021 22 Mutuals Funds Fund Investing

Register New Employees With Sss Philhealth And Pag Ibig Fund

How Epfo Calculates Interest On Your Pf Balance Details Explained Here Mint

Epf Employee Provident Fund Calculation Withdrawal Rules Interest Rate Youtube

St Partners Plt Chartered Accountants Malaysia Epf Monthly Contribution Rate For 2021 Is Available To Download The Third Schedule Please Click At Below Link Https Www Kwsp Gov My Documents 20126 927226 Bi Jadual Ketiga 2020 Kwsp Pdf

What S Taxable Under New Epf Rules All That You Need To Know Hindustan Times

- p. ramlee spouse

- kerajinan rumah rumahan dari stik es krim

- perancangan strategik kokurikulum 2017

- ucapan hari raya aidilfitri istimewa

- logo kemas tabika

- tanda tanda ada saka

- lampu dimmer led

- suhu badan normal anak berapa derajat

- gambar hiasan untuk mading

- cara cara melukis bunga raya

- tafsir mimpi al quran

- sheraton hotel surabaya review

- arti musang masuk dalam rumah

- adzan maghrib net tv

- kata-kata penghargaan

- pak chong national park

- hiasan pintu kelas flanel

- gambar buah buahan kartun hitam putih

- undefined

- epf contribution table 2019